30 Second Summary

- The past year has witnessed loss on the front of investment made by investors in share market, which understandably makes this area too risky to choose for investment.

- From the side of buyers, there is hope, growth and opportunity for greater return.

- Indian real estate market offers opportunity, regardless of the fact that it is on slowdown spree for one year.

- The surety of positive capital earning is perceptible with realty market, even though it is affected with scenario of moderate loss.

- Real estate investment will not ruin your life’s saving in one single night and will not push you on the edge of financial bankruptcy either.

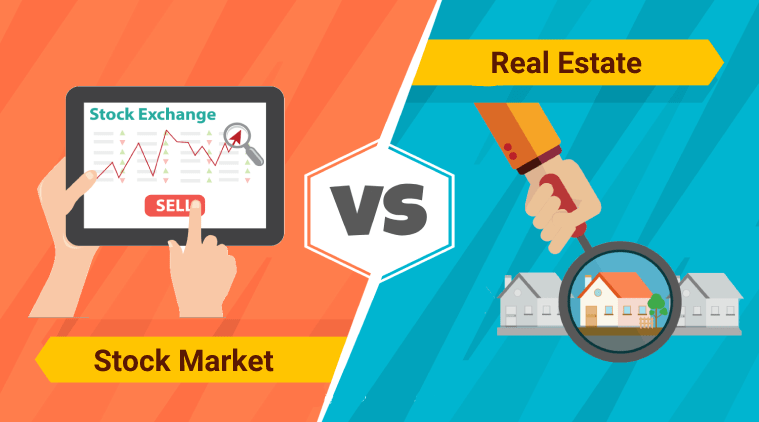

The international share market is basically known for its volatility. Means, it is difficult to predict its mood swings. Because of this eccentric tendency, the share market affects any country’s economic condition in one way or another. The past year has witnessed loss on the front of investment made by investors in share market, which understandably makes this area too risky to choose for investment.

Under such circumstances, when there is no doubt that the mood of the share or stock market is very hard to predict, real estate investment emerges to be a profoundly hopeful alternative in terms of empowering and increasing investor’s capital.

In this context, Indian real estate market offers opportunity, regardless of the fact that it is on slowdown spree for one year.

However, the sort of slowdown it is witnessing is mostly felt on the part of realtors or builders, as sales of properties are still to pick up speed. From the side of buyers, there is hope, growth and opportunity for greater return. In fact, for them, the current scenario of Indian realty market is relatively lucrative than it was in the past.

What is essential for the investor to earn great return from realty market is to have knowledge of various things, including locations, trusted builder etc.

Investing in Indian realty is profitable today

With builders having a huge number of unsold inventories in their credit, it is easily predictable that their cash flows are becoming poor and profit ratio is taking steep slope. Technically speaking, builders feel the pressing need for price moderation on their inventories coupled with attractive freebies, subventions, cheaper home loans and various other schemes they offer to perk up buyer’s sentiments.

While these steps, if taken and implemented on practical ground, can materialize the surge in sales of inventories; there is, however, one important thing to note – buyers are the king of realty market.

An asset that never loses its values

One of the key attributes of real estate investment is the benefit of having an asset the value of which always takes a gradual surge. Few years down the line, the investment made in property comes in your hand as a lucrative return/capital. If the return is compared with that of share market, difference on the front of irregular fluctuations in the value of shares is easily noticeable.

At least, there is no such lingering fear of loss with realty market where assured return or the benefit of having a stable asset is always present to convince you about the safety of your investment. The surety of positive capital earning is perceptible with realty market, even though it is affected with scenario of moderate loss. Real estate investment will not ruin your life’s saving in one single night and will not push you on the edge of financial bankruptcy either, as happens in the case of stock market with most of its investors.

Increasing surge in buyer’s sentiment with smart city projects

The likelihood of Central government’s ambitious ‘Smart City project’ instilling the sense of improved sentiment in market is very strong. The presumption is based on the fact that buoyancy will be felt all over India, especially in those cities nominated as smart cities by their respective State and subsequently approved by the Centre.

This further leads to straightforward conclusion that better and long-term returns will be generated from the investment, irrespective of the performance of share market worldwide.

Apart from the smart cities, the increasing presence of metro railways in big cities as more preferred means of civic transportation has given the rise to the construction of new real estate projects in the outer peripheries of the chosen smart cities. This will fulfill the housing needs of people migrating from rural areas to urban ones.

As a rule of thumb to earn profitable return, any investor can consult reputed builders operating in these areas. There is strong likelihood of getting right kinds of properties from the right developers, which means medium and long-term profitable return is bound to occur for the investors.

The rental opportunity to earn handsome income

There is always the virtue of reaping dual benefits from the property you’ve purchased through real estate investment. One benefit is you can lease out your property and witness the steady income inflow from tenant clients. The other benefit is you get the opportunity of having a property to operate your own business and save on rental outgo.

Either way, commercial property investment gives you the sustainable profitable return. This is the reason why realty market is witnessing steady surge in the demand of rental properties. This indicates why realty investment matters most in the context of earning decent revenue which is relatively better than that of share market investment.

Cheaper home loans at buyer’s disposal

Still not implemented nationwide, yet post RBI repo rate cut has prompted various lending institutions, including HDFC and SBI, to cut short on their lending rates so that home loans can be cheaper for home buyers. The plunge on interest rates will galvanize sentiments of fence-sitters, as they will not have to pay higher EMIs on their loans. Quite understandably, the real estate market offers greater opportunity for investors to earn substantial capital.

No risk of extreme volatility

Share market is always at the receiving end of total unpredictability, which makes investors doubtful to take the risk of investment in this sector. As a result, most of them make a beeline effort for a less risky potential venture, and realty comes off as a safe den in this context.

This is because of the reason that realty market, even suffering from serious loss or temporarily slowdown, there is always predictability that it will improve and positive transition will come.

Ironically, the stock market investment doesn’t offer that kind of certainty when it crashes headlong. Be it mutual fund, gold or others, they crash simultaneously, thus inflicting more serious damage on financial condition of investors. Realty market has its ups and downs, but volatility is never extreme in the sense of endangering investment.

In brief…

Although investment in real estate market is a time-intensive task, and there is also possibility that you run into costly process to meet your desirable option, but one thing for sure that entire processes will be of one-time hard work. No risk will come to your investment once you have got the hand on your best option. Yes, it is also a risk-prone area, but compared to stock market and other similar alternatives, real estate investment sounds better and logical choice as volatility is not extreme and there is always surety of return sooner or later, but certainly.